Not Comparable Horizontal Highlight - High

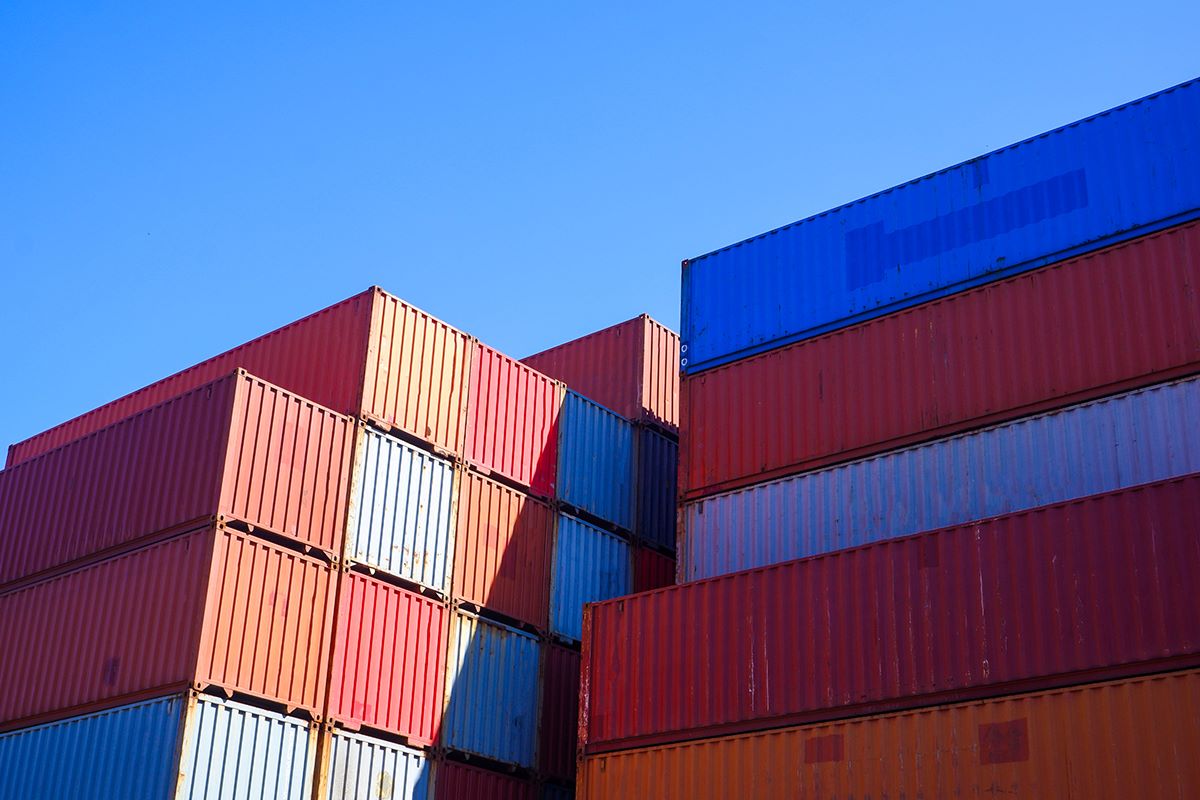

We carry out our activities in the Portuguese banking sector, with a business model centred on domestic commercial banking and corporate and individual banking, offering the full spectrum of financial products to individuals, companies and institutional clients.

Our 292 branches and 20 corporate centres cover the whole of Portugal. We are committed to serving and supporting the Portuguese business sector.

What we are translates into what we do and how we do it

We carry out our activities in the Portuguese banking sector, with a business model centred on domestic commercial banking and corporate and individual banking, offering the full spectrum of financial products to individuals, companies and institutional clients.

Our 292 branches and 20 corporate centres cover the whole of Portugal. We are committed to serving and supporting the Portuguese business sector.

Online, simples e rápido.

Abra uma conta em dois minutos.

Online

Online, simples e rápido.

Abra uma conta em dois minutos.

Through our branches and digital platforms, we endeavour to meet our customers' expectations by offering them an omnichannel experience based on transparent, simple and secure financial products and services.

Everything we do is based on the highest standards of integrity and trust, and we listen to our customers in order to better integrate their voice into our business.

Novobanco's business model is based on 2 commercial banking segments.

- Corporate

- Retail

-

Specialised sector expertise

Specialised sector expertise- Expert teams in factoring, confirming, leasing and trade finance

- Highly experienced team specialising in European funds (PRR and PT2020) with access to consultancy partners

- Expert teams in factoring, confirming, leasing and trade finance

-

Export and import

Export and import- Documentary credits and remittances

- External financing

- International factoring

- Forfaiting

-

Investment support

Investment support- Factoring and confirming

- Current accounts and overdrafts

- Online credit for business

- IFAP credit lines (advance)

-

Treasury management support

Treasury management support- Medium and long-term financing

- Leasing and renting solutions

- Credit lines with preferred conditions

- Medium and long-term financing

-

Payment methods and collections

Payment methods and collections- Direct debit transactions, POS, digital payments gateway

- Payments and transfers

- NB Express Cash to simplify cash management

-

Employee benefits

Employee benefits- Restaurant and credit cards

- Car solutions, with leasing and renting tailored to customers' needs

- Occupational injury and multi-risk insurance

-

Card, payment & accounts

Card, payment & accounts- Accounts for different purposes with online opening

- Strong authentication system (e.g. contactless, virtual cards, MB Way)

- Accounts for different purposes with online opening

-

Mortgage

Mortgage- Purchase and construction

- Online submission of the simulation

- Special conditions for young people and non-residents

-

Consumer credit

Consumer credit- Simulation and online submission

- Credit insurance with unemployment insurance and life insurance

- POS partnership: "Heypay"

-

Savings and investment

Savings and investment- Deposits and PPRs

- Investment funds, unit linked, structured deposits

- Discretionary management and consultancy

-

Insurance

Insurance- Life Insurance

- Health, Home and Car Insurance

- Personal and occupational injury protection

-

Small businesses

Small businesses- Business accounts for small companies

- Treasury and payment solutions

- Multi-risk business insurance

- Business accounts for small companies

Not Comparable Horizontal Highlight - High

We have rethought our distribution model and way of serving to adapt to new customer expectations and preferences.

The new distribution model brings together in a single concept the renewal of the physical branch network, the technological infrastructure, omnichannel, partnerships, new roles within the organisation, communication and relations with the community.

New distribution model

We have rethought our distribution model and way of serving to adapt to new customer expectations and preferences.

The new distribution model brings together in a single concept the renewal of the physical branch network, the technological infrastructure, omnichannel, partnerships, new roles within the organisation, communication and relations with the community.

Online, simples e rápido.

Abra uma conta em dois minutos.

Online

Online, simples e rápido.

Abra uma conta em dois minutos.

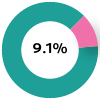

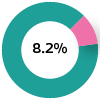

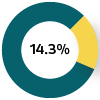

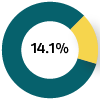

Market shares

-

Global

Global+0.2pp YoY

-

Trade finance

Trade finance+1.7pp YTD

-

Mortgage loans

Mortgage loansstable YoY

-

Households

Households+0.1pp YoY

-

Corporate credit

Corporate credit+0.2pp YoY

-

Corporate

Corporate+0.5pp YoY

as of May 2023

The market recognizes our performance with awards and recognitions

- 2024

- 2023

- 2022

- 2021

-

Global Finance Magazine

Global Finance MagazineBest Trade Finance Provider

-

Covered Bond Report awards

Covered Bond Report awardsBest Debut

-

Global Capital Awards

Global Capital AwardsBest Pioneering Deal

-

SRP Europe Awards

SRP Europe Awards"Best Distributor, Portugal" for structured retail products

-

Jornal de Negócios/APFIPP

Jornal de Negócios/APFIPP- GNB Portugal Ações, Best fund in the ‘National Shares ICO’ category

- GNB Dinâmico, Best fund in the ‘Aggressive Multi-Asset UCI’ category

- GNB Portugal Ações, Best fund in the ‘National Shares ICO’ category

-

2023

-

The Banker (Financial Times) Awards

The Banker (Financial Times) AwardsNovobanco is "Bank of the Year 2023" in Portugal

-

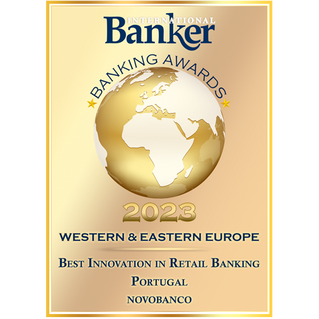

The International Banker Awards

The International Banker AwardsNovobanco winner of the Best Innovation in Retail Banking award

-

SCI CRT Awards

SCI CRT AwardsNovobanco winner of the Transaction of the year award

-

Global Finance awards

Global Finance awardsNovobanco named the top Trade Finance Provider in Portugal for the fifth consecutive year by "Global Finance" magazine.

-

Refinitiv Lipper Fund Awards

Refinitiv Lipper Fund AwardsNB Euro Bond fund honored as the best Euro bond fund in Europe for the 12th year, excelling over the last 3, 5, and 10 years.

-

SRP Europe Awards

SRP Europe AwardsNovobanco wins "Best Distributor, Portugal" award, reaffirming international recognition for its strong and consistent performance in Structured Products.

2022

-

Global Finance awards

Global Finance awardsNovobanco wins the following categories:

- Best sub-costudian Bank

- Best Trade finance provider

-

D-Rating awards

D-Rating awardsNovobanco recognized as Best performer in digital Retail Banking in Portugal

-

Jornal de Negócios / APFIPP awards

Jornal de Negócios / APFIPP awardsGNB Gestão de Ativos wins 2 awards

-

Banking Tech Awards

Banking Tech AwardsNovobanco's app wins Best Mobile Initiative for the second year

-

SRP Europe Awards

SRP Europe AwardsNovobanco wins Best distributor Portugal

-

Rankia Portugal

Rankia PortugalGNB Gestão de Ativos wins best retirement fund category

-

Finovate Awards

Finovate AwardsDigital remote signature iniciative makes the shortlist of the award for best user experience

-

Human resources awards

Human resources awardsNovobanco wins best use of technology in HR by the IIRH – Instituto de Informação em Recursos Humanos

-

2021

-

Global Finance awards

Global Finance awardsNovobanco wins:

- Best sub-custodian Bank in Portugal

- BestTrade Finance Provider in Portugal

-

SRP Europe Awards

SRP Europe AwardsNovobanco elected Best Distributor, Portugal

-

Issuance of the Republic's debt by IGCP

Issuance of the Republic's debt by IGCPNovobanco was once again the only Portuguese bank in the chosen consortium

-

Digital CX awards

Digital CX awardsNovobanco's online insurance subscription solution wins

-

Banking Tech Awards

Banking Tech AwardsNovobanco's app wins Best Mobile Initiative

-

Portugal Digital Awards

Portugal Digital AwardsNovobanco's app do makes the shortlist

-

Jornal de Negócios / APFIPP awards

Jornal de Negócios / APFIPP awardsGNB Gestão de Ativos awarded with the following products:

- NB Euro Bond

- NB PPR

- PPR Vintage

-

Refinitiv Lipper Fund Awards

Refinitiv Lipper Fund AwardsNB Eurobond of GNB Gestão de Ativos wins

-

Cfi.co Awards

Cfi.co AwardsGNB Gestão de Ativos honoured for Best Bond Fund Manager (Portugal)

Awards are the sole responsibility of the organisations granting them